Developing DevOps Strategies Using Crowd Sourcing

by Steve Hendrick, Research Director, Application Management

The dynamics of the overall DevOps market are not well understood. DevOps includes over 25 different tool categories or market segments. This creates a conundrum for enterprises looking to operationalize agile technologies. Where to start and how to move forward become complex issues for enterprises looking to leverage the benefits and business value that DevOps provides.

Recent EMA research was designed to address just this issue, as well as explore the competitive dynamics of selected DevOps market segments. EMA launched its worldwide DevOps 2020 survey in June of this year and collected information on DevOps tool category use, DevOps maturity, and customer feedback on products in use across eight of the 20 market segments that the survey analyzed. Summary-level results of the survey are available via the on-demand webinar. However, here are some highlights of what was discussed in this webinar.

The DevOps 2020 survey collected DevOps tool use information from 419 senior IT managers in large enterprises across twenty DevOps market segments. This information is being analyzed, and the longitudinal dimensionality of the data will drive an understanding of tool category penetration rates and growth rates. The difference between tool categories currently in use and tool categories planned for use over each of the next several years will enable the development of a DevOps maturity model.

Survey-based deep dives were also performed on eight of the twenty DevOps market segments analyzed. These deep dives identified specific tools in use, the effectiveness of these tools, customer satisfaction, and the top reasons driving tool choice.

DevOps Tool Category Use

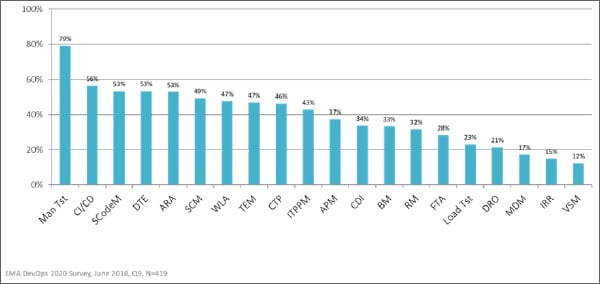

Figure 1 provides a glimpse into tool category use across the twenty DevOps market segments that EMA asked about. For each market segment, the respondents were asked if they currently use the tool, planned to use a tool later in 2018, planned to use a tool in 2019, planned to use a tool in 2020, or had no plans to use a tool. This data, along with other questions in which the respondent was asked to self-assess the enterprise’s DevOps maturity, provide a rich ecosystem of actions, decisions, and dependencies that are driving development of EMA’s DevOps maturity model.

Figure 1. DevOps 2020 Current Tool Category Use by Market Segment

Source: EMA, 2018

The strong focus that large enterprises have on starting their DevOps journey with manual testing, CI/CD, source code management, dev/test environment creation, and application release automation is clearly shown. The use of these tools to always look at DevOps is characteristic of what is required to start a DevOps journey. Companies need a repository to manage source code, CI/CD tools to enable fast and iterative code development, DTE tools that provide sandboxing support manual testing tools, tools that are an on-ramp to application quality, and ARA tools help move applications from development to deployment.

While the data shows that this is a clear starting point for large enterprises to begin their DevOps journey, the path forward from here is far more complex. While the penetration rate of tool categories in Figure 1 clearly has a bearing on how enterprises will mature their DevOps strategy, a more detailed look at planned tool category usage relative to current usage will be combined with self-assessment data and stated objectives necessary in order to develop a stepwise maturity model.

DevOps Innovators and Top Three Products

The deep dives into eight of the twenty markets included in the DevOps 2020 survey provide a customer-driven way to understand product penetration, product effectiveness, and product satisfaction. EMA developed a scoring algorithm from this data that identified vendors and products in each of these eight market segments who were innovators and market leaders. This approach, based entirely on customer-driven assessments, enabled EMA to publish a summary report identifying innovators and the top three award winners in each of these eight markets. More information is available in the DevOps 2020 award summary.

Future Research Activities

This DevOps 2020 survey was also highly effective at identifying a number of extremely high-growth DevOps market segments. EMA is currently accepting sponsorships for the follow-on to this study, which is DevOps 2021. Ultra-high growth areas, including value stream management, ITIM, AIOps, and image registries/repositories, are a key focus of DevOps 2021. Check out the comprehensive list of 2019 EMA research projects. For questions on EMA’s DevOps 2021 survey, feel free to contact Steve Hendrick.